The Benefits of Short-Term Loans: Advantages of Emergency Lending

When faced with unexpected expenses or financial challenges, short-term loans can provide a quick and easy solution. The benefits of short-term loans have led to a shift in financial lending trends across South Africa, with loan usage increasing to 9.1% throughout 2023 With fast cash and minimal paperwork, same-day lenders easily appeal to individuals facing cash shortfalls.

Flexibility, speed, and easy application processes are just a few of the advantages of short-term loans - but what else do they entail? Throughout this guide, we will explain exactly what a short-term loan is, the different same-day loan benefits, the various risks and how you can apply.

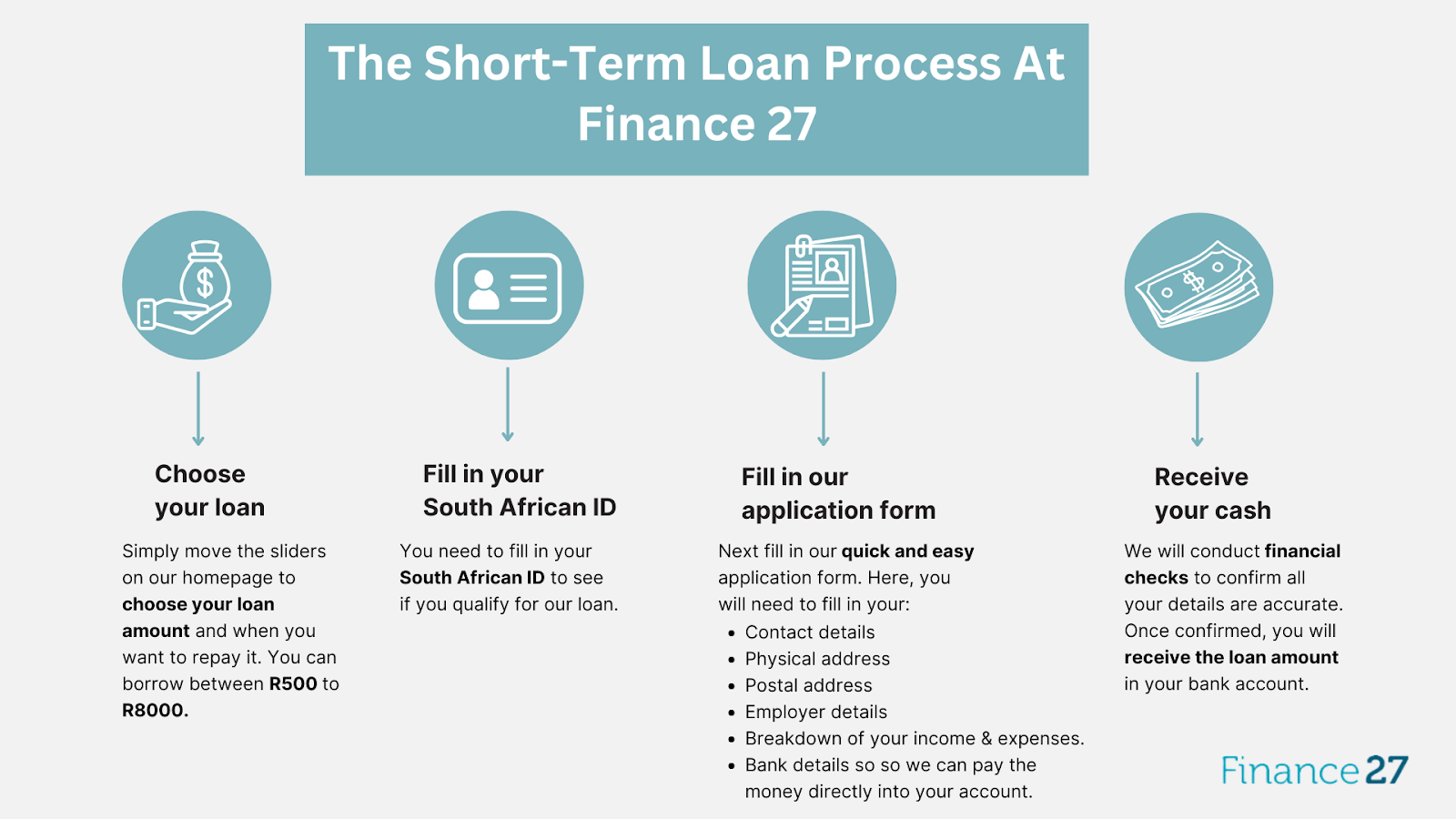

At Finance27, we provide a simple and instant online credit solution for those in need. With repayment periods of up to 65 days, we can support you through those unexpected emergencies and overwhelming expenses. Start your short-term loan process today with our 3 easy steps!

What Are Short-Term Loans?

Short-term loans are a quick finance option for any unexpected bills or emergency expenses or to manage your cash flow. With short-term loans, you repay the loan in monthly payments within a short period of time. You can borrow anything from R 1,000 to R 6,000 depending on your circumstances.

Short-term loans are suitable for both personal and business financial needs. Whether you need to pay for an unexpected car payment or you are a business owner needing to cover a business expense, short-term loans are suitable to cover your financial difficulties temporarily.

6 Benefits Of Short-Term Loans

At Finance27, we recognise short-term loans as an excellent financial tool for solving emergencies. The primary advantages of short-term loans lie in their simplicity - which is why we provide an instant approval process with no hidden fees. For more information on our short-term loan process, check out our FAQs page! For more information on our short-term loan process, check out our FAQs page!

Below, you can find a comprehensive list of same-day loan benefits:

Flexibility

No time to go to the bank because of work? Have you got childcare responsibilities? With short-term loans, you aren't limited to bank opening and closing times like traditional loans. You can apply for short team loans in your own time, 24/7 hours a day, whenever and wherever suits you best.

Urgent Finance Needs

We all experience unexpected payments at the worst times. Whether it be unexpected costs, car repairs, or emergency health payments, short-term loans are an excellent tool to resolve those unexpected payments and give you access to funds quickly.

Quick Application Process

Short-term loans cancel out conventional bank meetings, filled with lots of paperwork and long meetings. With short-term loans, you can apply for a loan with a simple and quick online application form which can take less than 10 minutes.

Access To Cash Quickly

Unlike traditional long-term loans, you don't need to wait weeks or months for a loan. Short-term loans have an efficient approval process for you to gain quick funding within 24/hours due to the quick application process. This allows you to resolve those financial problems that have been burdening you with quick cash.

Flexible Loan Amounts

Short-term loans allow you to choose the exact loan amount you may need for financial emergencies. You have the flexibility to choose from as little as R 900 to as high as R 5000.

Quick Loan Repayment Process

When applying for a short-term loan, you have shorter repayment terms in comparison to traditional long-term loans. This enables you to pay off those lingering debts or bills within a shorter repayment period. This minimises your long-term debt and is beneficial for financial planning.

Risks Of Short-Term Loans

You must understand the risks of short-term loans. It is crucial to understand what your repayment terms are. For example, it may look like paying in monthly repayments. Failure to pay your loan on time will lead to a cycle of debt and negatively impact your credit score. A poor credit history can impact your application for loans in the future.

Receive Same-Day Short-Term Loans Today

At Finance 27, we offer same-day short-term loans, online for our clients across South Africa. From Cape Town to Katch, we have successfully provided clients with short-term financial relief while avoiding extensive debt.

Our loan amounts range from as little as R 1,000 to R 6,000. We have made our loan application process quick and easy so you can receive your funds quickly. Simply choose your loan amount, and fill in a quick application form with your contact and bank details to receive your loan funds.

If you require any financial advice or assistance, please call or email us and our friendly team will be more than happy to help you.

Register with us today